December 31, 2011 12:00 PM CST

“The construction industry has struggled to see recovery take hold over the past couple of years. After plunging 24% in 2009, new construction starts leveled off in 2010 and have hovered within a set range during 2011,” said Robert Murray, Vice President of Economic Affairs, McGraw-Hill Construction. “The backdrop for the construction industry is the fragile U.S. economy, which continues to see slow employment growth, diminished funding from federal and state governments, and pervasive uncertainty. In 2012, the top-line numbers are not expected to show much change, but there will be variation within the major construction sectors, with some gains predicted for housing and commercial building assuming the U.S. economy avoids recession.”

Based on significant research and in-depth analysis of macro-trends, the 2012 Dodge Construction Outlook details the forecasts for each construction sector, as follows.

Copies of the report can be ordered online. Additional reports and projections are available from McGraw-Hill Construction Research and Analytics, http://construction.com/market_research.

The Outlook 2012 Executive Conference is produced by McGraw-Hill Construction. The platinum sponsor is the American Institute of Steel Construction. Gold sponsors include CMiC, Hill International, and United Rentals. The Associated General Contractors of America, American Society of Civil Engineers, and Astadia are silver sponsors. Supporting sponsors include the American Subcontractors Association, the Construction Specifications Institute, and the Society for Marketing Professional Services.

Housing, commercial building construction starts may improve in 2012

Commercial, manufacturing construction are bright spots

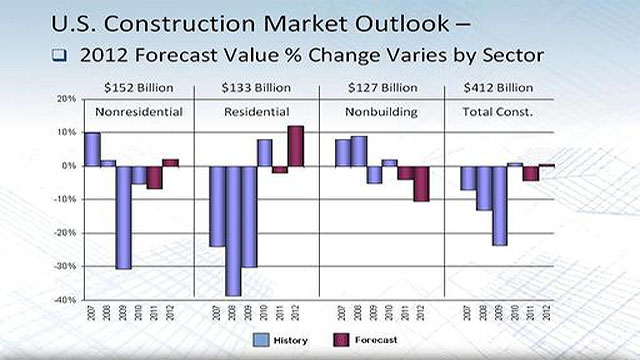

The level of construction starts in 2012 is expected to be $412 billion.

McGraw-Hill Construction, part of The McGraw-Hill Companies (NYSE: MHP), released its 2012 Dodge Construction Outlook, a mainstay in construction industry forecasting and business planning, which predicts that overall U.S. construction starts for next year will remain essentially flat. The level of construction starts in 2012 is expected to be $412 billion, following the 4% decline to $410 billion predicted for 2011.“The construction industry has struggled to see recovery take hold over the past couple of years. After plunging 24% in 2009, new construction starts leveled off in 2010 and have hovered within a set range during 2011,” said Robert Murray, Vice President of Economic Affairs, McGraw-Hill Construction. “The backdrop for the construction industry is the fragile U.S. economy, which continues to see slow employment growth, diminished funding from federal and state governments, and pervasive uncertainty. In 2012, the top-line numbers are not expected to show much change, but there will be variation within the major construction sectors, with some gains predicted for housing and commercial building assuming the U.S. economy avoids recession.”

Based on significant research and in-depth analysis of macro-trends, the 2012 Dodge Construction Outlook details the forecasts for each construction sector, as follows.

- Single family housing in 2012 will improve 10 percent in dollars, corresponding to a 7 percent increase in the number of units to 435,000 (McGraw-Hill Construction Dodge basis). This is still a low amount, as the excess supply of homes due to foreclosures continues to depress the market.

- Multifamily housing will rise 18 percent in dollars and 17 percent in units, continuing its moderate, upward trend.

- Commercial building will grow 8 percent. Warehouses and hotels will see the largest percentage increases, but improvement for offices and stores will be modest.

- The institutional building market will slip an additional 2 percent in 2012, after falling 15 percent in 2011. The tough fiscal environment for states and localities will continue to dampen school construction, and the uncertain economic environment will limit growth in healthcare facilities.

- Manufacturing buildings will increase 4 percent, following the 35 percent gain in 2011, as the low value of the U.S. dollar continues to support export growth.

- Public works construction will drop a further 5 percent, after a 16 percent decline in 2011, due to spending cuts and the absence of a multiyear federal transportation bill for highway and bridge construction.

- Electric utilities will retreat 24 percent, following a 48 percent jump in 2011.

Copies of the report can be ordered online. Additional reports and projections are available from McGraw-Hill Construction Research and Analytics, http://construction.com/market_research.

The Outlook 2012 Executive Conference is produced by McGraw-Hill Construction. The platinum sponsor is the American Institute of Steel Construction. Gold sponsors include CMiC, Hill International, and United Rentals. The Associated General Contractors of America, American Society of Civil Engineers, and Astadia are silver sponsors. Supporting sponsors include the American Subcontractors Association, the Construction Specifications Institute, and the Society for Marketing Professional Services.

About the Author

Kathy Malangone is the Senior Director of Marketing Communications for McGraw-Hill Construction.