June 17, 2011 3:30 PM CDT

Europe is a diversified market for mobile elevating work platform (MEWP) rentals and 2010 was a year of sharp contrasts, with a difficult first half year and improvements seen in the second half. Growth is expected to be gradual at around 5% per year for 2011 and 2012.

“Europe is a very diversified market for MEWP rentals in terms of fleet mix and price levels,” said IPAF CEO Tim Whiteman. “There is no European market per se, but more a multi-country market. It is a market driven by specialists, such as in Germany, Benelux and Italy, who have been less affected by the crisis and resumed faster growth.”

The results are based on independent studies conducted by Ducker Research, using mainly primary research in the form of interviews. The sample of rental companies interviewed here represented about 60% of the estimated total MEWP rental market. The European study covers 11 countries: Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden and the UK. Seven individual country/regional sections are included in the European report.

The reports are presented in an easy-to-read format, highlighting key facts and figures for senior management, such as fleet size, utilisation rate and retention period. New for this year is the analysis of fleet mix, comparing the proportion of scissors and booms. In Europe, booms represent around 46% and scissors account for about 49% of the fleet. IPAF has also published the IPAF US Powered Access Rental Report 2011.

“These reports from IPAF are invaluable in providing an insight into the current powered access rental market,” said Kevin Appleton, chief executive of the Lavendon Group, one of the largest access rental companies in Europe. “They identify future trends, issues and opportunities which may affect those in it. I have found them to be essential reading and would recommend them to anyone responsible for powered access rental management.”

The IPAF US and European Powered Access Rental Reports 2011 are available in English and can be purchased at IPAF Rental Reports.

Steady Growth Expected in European Powered Access Market

IPAF rental reports

By International Powered Access Federation

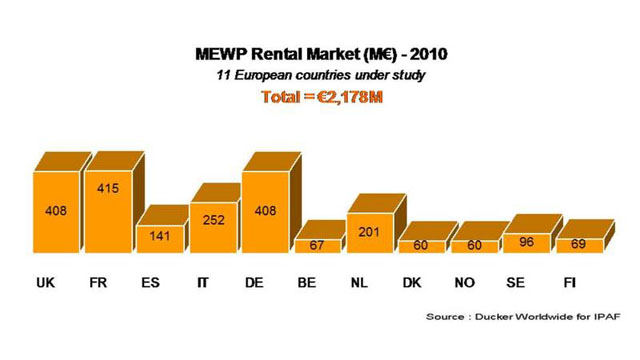

The MEWP rental market across the 11 European countries under study.

According to the IPAF European Powered Access Rental Report 2011, MEWP rental revenues in the 11 European countries surveyed remained stable and are estimated at €2.2 billion in 2010. This figure represents around 85% of the total European market (defined as the 27 countries plus Norway), which would attain a MEWP rental market value of approximately €2.6 billion.Europe is a diversified market for mobile elevating work platform (MEWP) rentals and 2010 was a year of sharp contrasts, with a difficult first half year and improvements seen in the second half. Growth is expected to be gradual at around 5% per year for 2011 and 2012.

“Europe is a very diversified market for MEWP rentals in terms of fleet mix and price levels,” said IPAF CEO Tim Whiteman. “There is no European market per se, but more a multi-country market. It is a market driven by specialists, such as in Germany, Benelux and Italy, who have been less affected by the crisis and resumed faster growth.”

The results are based on independent studies conducted by Ducker Research, using mainly primary research in the form of interviews. The sample of rental companies interviewed here represented about 60% of the estimated total MEWP rental market. The European study covers 11 countries: Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden and the UK. Seven individual country/regional sections are included in the European report.

The reports are presented in an easy-to-read format, highlighting key facts and figures for senior management, such as fleet size, utilisation rate and retention period. New for this year is the analysis of fleet mix, comparing the proportion of scissors and booms. In Europe, booms represent around 46% and scissors account for about 49% of the fleet. IPAF has also published the IPAF US Powered Access Rental Report 2011.

“These reports from IPAF are invaluable in providing an insight into the current powered access rental market,” said Kevin Appleton, chief executive of the Lavendon Group, one of the largest access rental companies in Europe. “They identify future trends, issues and opportunities which may affect those in it. I have found them to be essential reading and would recommend them to anyone responsible for powered access rental management.”

The IPAF US and European Powered Access Rental Reports 2011 are available in English and can be purchased at IPAF Rental Reports.

About the Author

IPAF is the parent organization of North America's Aerial Work Platform Training (AWPT). Both are not-for-profit member organizations that promote the safe and effective use of powered access equipment. Find more information at www.ipaf.org.