Obama should pay his fair share

The president should offer a personal sacrifice for others to follow

President Obama, the architect of the “pay your fair share" movement, has been a sounding board for a more equitable federal tax code. To make his case, the president often cites the situation of billionaire Warren Buffett, who pays a lower marginal rate than his secretary.

Without actually proposing a comprehensive overhaul plan, the president has been consistent in his desire for the wealthiest to pay more in taxes to help balance the budget and pay for government services.

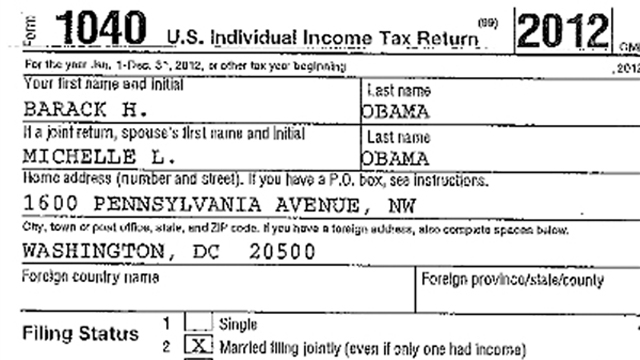

Every April, most media outlets report on the tax return filed for the first family. This year, they reported something strange – the Obama’s paid an effective tax rate of 18.4% based on their income of $608,611. The lower rate can be attributed to their charitable gifts ($150,034 or 24.6%).

Despite their generous giving, this appears low for someone who laments higher income earners for somehow gaming the system.

Mr. Obama now finds himself in an embarrassing Warren Buffett moment, where he is paying a lower rate than Joe Biden who contributes 22.8 percent. What is worse, this is just slightly more than the robber barron rate that Governor Romney was roundly criticized for – about 14 percent.

Certainly Obama can claim he is the victim of a tax regime that he did not design, and Congress has not reformed. And while Romney’s taxes are different that Mr. Obama’s, a higher rate should be levied on the president for a few reasons.

First, the president is a true believer in the highest 39.6 percent for top earners – spending quite a bit of political capital to reinstate it.

Second, if President Clinton’s presentation at the Democratic National Convention is to be believed, every tax payer should strive to adhere to the higher rate to balance the budget and provide the kind of economic growth experienced in the early 1990’s.

Because fairness and financial equality are cornerstone issues for this president, he should practice what he preaches by giving back a much higher percentage of his income.

How can he pay more? By simply taking advantage of a Department of Treasury program that allows taxpayers to make gifts to help bring down the national debt.

The move, while somewhat symbolic, could motivate others and usher in the kind of change he campaigned on in 2008 and 2012.

After making a contribution to meet the 39.6 percent threshold, the president can harness the power of bully pulpit by using every official visit and campaign stop to promote a little-known program.

Lest anyone think the program does not make a difference, this year taxpayers have already contributed more than $900,000 dollars to the program. This pales in comparison to 2012, where concerned citizens gave up nearly $8 million of their hard earned dollars to help pay off the national debt.

Imagine the dent they could make if the president, his cabinet, staff, and wealthy political contributors took matters into their own hands and contributed their “fair share” to rein in the debt and deficit.

This would be community organizing at its best – a movement that requires no act of Congress, is completely voluntary, and allows true believers to live up to the ideals they hold so dear.

It is an understatement to say that leaders in Washington have had a hard time coming to agreement on anything; fundamental reform of our tax code will be no different. But if the president is as serious about tackling our fiscal woes, he would be well served in setting an example, and offering a personal sacrifice for others to follow.

About the Author

Matthew B. Keelen, founder and President of the government affairs firm The Keelen Group, is a widely known and highly regarded lobbyist and political strategist with experience building relationships with key figures and a reputation for consistently delivering hard-earned victories. Acknowledged for his innate ability to establish and develop long lasting political relationships, Keelen has dozens of time-tested relationships with Members of Congress, including many who are in positions of considerable influence today. To learn more about The Keelen Group, visit www.keelengroup.com.